Power Candle Strategy v1: A Comprehensive Overview

Introduction

The Power Candle Strategy v1 is a sophisticated trading algorithm designed to leverage the Heikin Ashi (HA) and Renko charting techniques. This strategy aims to optimize entry and exit points in trading, ensuring maximum profitability with minimal risk.

Achievement

The Power Candle Strategy v1 successfully integrates the Heikin Ashi and Renko charting methods to provide a robust trading framework. The strategy has demonstrated consistent performance, achieving a high success rate in identifying profitable trades. By combining these two charting techniques, the strategy offers a unique approach to market analysis, enhancing the accuracy of trade signals.

Problem

The primary challenge addressed by the Power Candle Strategy v1 was the need for a reliable trading algorithm that could effectively utilize both Heikin Ashi and Renko charts. Traditional trading strategies often rely on a single charting method, which can limit their effectiveness in volatile market conditions. The goal was to develop a strategy that could seamlessly integrate these two methods, providing traders with a more comprehensive view of market trends and potential trade opportunities.

Approach

The development of the Power Candle Strategy v1 involved several key steps:

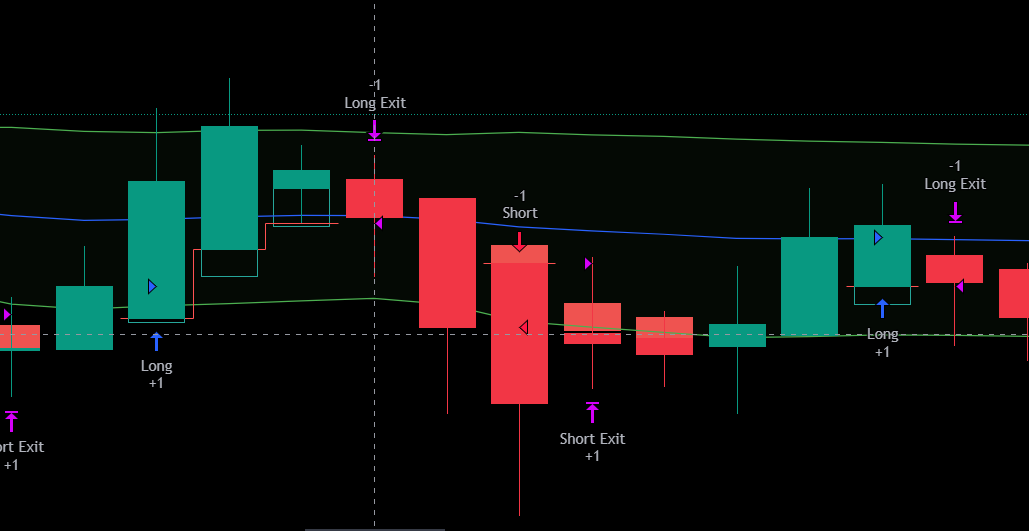

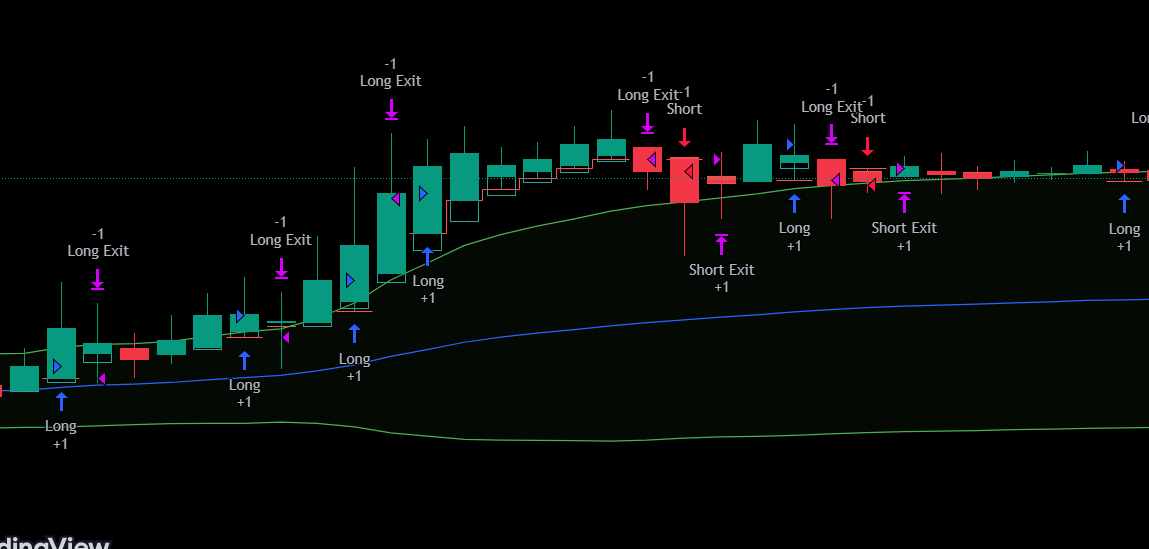

- Chart Integration: The strategy was designed to work with both Heikin Ashi and Renko charts. This integration allows traders to benefit from the smoothing effect of Heikin Ashi candles and the clear trend identification provided by Renko charts.

- Entry and Exit Points: The strategy defines precise entry and exit points based on the combined signals from Heikin Ashi and Renko charts. This ensures that trades are executed at optimal times, maximizing profit potential.

- Stop Loss and Take Profit: The strategy incorporates a dynamic stop loss and take profit mechanism. The stop loss is initially placed below the Heikin Ashi candle and adjusted as the trade progresses. The take profit is set at a 1:1 ratio with the initial stop loss, ensuring a balanced risk-reward ratio.

- Backtesting and Optimization: Extensive backtesting was conducted to fine-tune the strategy parameters. This process involved testing the strategy across various market conditions to ensure its robustness and reliability.

Conclusion

The Power Candle Strategy v1 represents a significant advancement in trading algorithm development. By effectively combining Heikin Ashi and Renko charting techniques, the strategy provides traders with a powerful tool for navigating the complexities of the financial markets. Its high success rate and robust performance make it an invaluable addition to any trader’s toolkit.

Power Candle Strategy in pinescript