In the fast-paced world of cryptocurrency trading, market moves are often driven not just by numbers but by emotions, news, and social chatter. Today, we explore how AI-driven sentiment analysis can provide traders with a powerful edge by quantifying the collective mood and opinions of market participants in real time. At aidea solutions, we’re dedicated to integrating cutting-edge technology with market insights to empower traders. In this comprehensive guide, we’ll discuss technical methods, real-time examples, and practical implementations that merge natural language processing (NLP) with cryptocurrency trading strategies.

Introduction

Cryptocurrency markets are notorious for their volatility, where prices can swing dramatically within minutes. Traditional analysis, based solely on historical price data or technical indicators, often falls short of explaining these abrupt moves. More and more, traders are turning to sentiment analysis—a technique that extracts, measures, and quantifies the emotions and opinions expressed in news articles, social media posts, and discussion forums. By doing so, sentiment analysis converts qualitative data into actionable quantitative signals.

At aidea solutions, we believe that combining sentiment insights with trading algorithms can significantly improve decision-making. This blog post is designed for traders, data scientists, and AI enthusiasts looking to understand and implement sentiment analysis to forecast crypto market trends. We’ll take you through the theory, tools, real-time examples, and practical steps needed to build a robust sentiment analysis system.

Understanding Sentiment Analysis in Crypto Trading

Sentiment analysis refers to the computational process of extracting subjective information from text. In crypto trading, it involves:

- Evaluating Public Opinion: Measuring whether the overall sentiment around a cryptocurrency is positive, negative, or neutral.

- Quantifying Emotions: Using NLP to assign numerical values (or sentiment scores) based on the language used.

- Predicting Market Movements: Correlating sentiment scores with price changes to potentially forecast market trends.

For instance, a sudden surge in negative sentiment on Twitter or Reddit might indicate impending price drops or a pump-and-dump scheme. Conversely, overwhelming positive sentiment—if verified to be organic—can signal a potential rally. However, sentiment alone is not a silver bullet; it must be combined with technical analysis and risk management for a truly robust trading strategy.

Data Sources and Collection Techniques

Social Media and News Platforms

The backbone of sentiment analysis is high-quality, real-time data. Key sources include:

- Twitter: With its fast-paced updates, Twitter provides a wealth of opinions and discussions on cryptocurrencies.

- Reddit: Subreddits such as r/CryptoCurrency are treasure troves of user opinions and discussions.

- News Articles: Financial news websites like CoinDesk, CoinTelegraph, and CryptoSlate offer in-depth analysis and breaking news.

- Forums and Blogs: Community forums provide insights from experienced traders and enthusiasts.

APIs and Web Scraping

To collect data, developers typically use:

- X(Twitter) API & snscrape: To retrieve tweets related to cryptocurrencies.

- News APIs: Such as CryptoControl or NewsAPI, which offer sentiment data from various news outlets.

- Web Scraping: Custom scripts to gather data from Reddit threads and crypto news sites.

AI and NLP Techniques for Sentiment Analysis

There are several techniques to perform sentiment analysis. Here are some popular methods used in crypto trading:

Lexicon-Based Approaches

- VADER (Valence Aware Dictionary and sEntiment Reasoner):

A rule-based model specifically tuned for social media text. VADER considers punctuation, capitalization, and degree modifiers to assign a sentiment score. It’s fast and effective for real-time applications.

Example Use-Case:

Detecting when a sudden increase in exclamatory posts (e.g., "OMG, Bitcoin is skyrocketing!!!") might signal a bullish market sentiment.

Transformer Models

- BERT and RoBERTa:

These models can be fine-tuned on cryptocurrency-specific datasets to capture context and nuances in financial language. They outperform traditional methods by understanding context better. - GPT-4:

GPT-4 can generate summaries, extract sentiments, and even provide predictive insights when fine-tuned. For instance, it can summarize news articles and assign sentiment scores that reflect the underlying tone of the piece.

Real-World Example:

In a project such as Satarupa22-SD/Cryptocurrency-Sentiment-Analysis, a fine-tuned RoBERTa model is used to classify tweets about Bitcoin and Ethereum into positive, negative, and neutral categories. This classification helps traders decide whether to enter or exit positions.

Implementing a Sentiment Analysis Bot: A Step-by-Step Guide

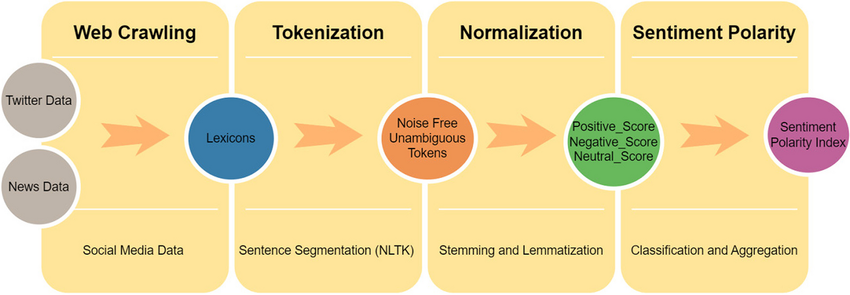

1. Data Retrieval and Preprocessing

Start by collecting data from Twitter, Reddit, and crypto news sites.

- Data Cleaning: Remove URLs, hashtags, and non-text elements.

- Normalization: Convert text to lowercase and remove stop words.

- Tokenization: Break down text into tokens for analysis.

Python Example:

python

CopyEdit

import re import pandas as pd from nltk.corpus import stopwords def clean_text(text): text = re.sub(r'http\S+', '', text) # Remove URLs text = re.sub(r'@\w+', '', text) # Remove user mentions text = text.lower() # Convert to lowercase tokens = text.split() tokens = [word for word in tokens if word not in stopwords.words('english')] return " ".join(tokens) # Assume tweets_df is a DataFrame containing a column 'tweet' tweets_df['clean_tweet'] = tweets_df['tweet'].apply(clean_text)

2. Sentiment Scoring

Apply a sentiment analysis algorithm to score the cleaned text.

- Using VADER:

python

CopyEdit

from vaderSentiment.vaderSentiment import SentimentIntensityAnalyzer analyzer = SentimentIntensityAnalyzer() tweets_df['sentiment'] = tweets_df['clean_tweet'].apply(lambda x: analyzer.polarity_scores(x)['compound'])

- Aggregation: Combine sentiment scores with engagement metrics (likes, retweets, followers) to form a weighted sentiment score.

3. Real-Time Analysis and Visualization

Once sentiment scores are calculated, integrate them with live crypto price data.

- Correlation Analysis: Use statistical methods (e.g., Pearson correlation) to analyze the relationship between sentiment scores and price movements.

- Visualization: Plot real-time sentiment against crypto prices using libraries like Matplotlib or Plotly.

Example:

python

CopyEdit

import matplotlib.pyplot as plt plt.figure(figsize=(12,6)) plt.plot(crypto_price_data['timestamp'], crypto_price_data['close'], label='Crypto Price') plt.plot(sentiment_data['timestamp'], sentiment_data['sentiment'], label='Sentiment Score') plt.xlabel('Time') plt.ylabel('Value') plt.title('Real-Time Crypto Price vs Sentiment Score') plt.legend() plt.show()

4. Trading Strategy Integration

Develop algorithms that use the aggregated sentiment data as signals for trading.

- Threshold-Based Trading: Set thresholds for sentiment scores to trigger buy or sell orders.

- Machine Learning Models: Combine sentiment features with historical price data to predict future price movements using regression or classification models.

- Backtesting: Validate your strategy using historical data before deploying it in a live environment.

Example:

python

CopyEdit

def trading_signal(sentiment_score, price): if sentiment_score > 0.5 and price is trending upward: return "BUY" elif sentiment_score < -0.5 and price is trending downward: return "SELL" else: return "HOLD" # Apply trading signal logic to your dataset tweets_df['signal'] = tweets_df['sentiment'].apply(lambda score: trading_signal(score, current_price))

5. Deployment

Deploy your bot on a server or cloud platform to run continuously. Use tools like Docker for containerization and Kubernetes for orchestration. For example, a Dockerfile might encapsulate your environment:

dockerfile

CopyEdit

FROM python:3.9-slim COPY requirements.txt /app/ RUN pip install -r /app/requirements.txt COPY . /app WORKDIR /app CMD ["python", "monitor.py"]

Configure a scheduler (e.g., cron job) to run the script at desired intervals for real-time monitoring.

Real-Time Examples and Use Cases

Example 1: Detecting Pump-and-Dump Schemes

Imagine a scenario where a sudden influx of negative tweets about a lesser-known altcoin is detected. The sentiment analysis bot, processing thousands of tweets per minute, registers a sharp decline in sentiment. When correlated with an unexpected spike in trading volume, the system flags a potential pump-and-dump scheme. Traders can then avoid entering positions during this period or even short the asset if the strategy allows.

Example 2: Gauging Market Reaction to News

Following a major regulatory announcement, news outlets release articles with mixed sentiments. By feeding these articles into your sentiment analysis pipeline, your bot can aggregate the sentiment score and compare it against historical trends. For instance, if the aggregated score falls significantly below a predefined threshold, it might indicate that the market is overly pessimistic, presenting a potential buying opportunity for contrarian investors.

Example 3: Social Media Hype and FOMO

During a viral social media campaign, influential personalities tweet bullish forecasts about a particular cryptocurrency. Your bot, using real-time sentiment analysis, captures this surge in positive sentiment. When the bot correlates the sentiment spike with a sudden price increase, it can generate a "BUY" signal. Conversely, if the hype seems artificially inflated, the system might prompt caution, preventing impulsive decisions driven by FOMO (Fear of Missing Out).

Example 4: Integrating Sentiment with Technical Analysis

By combining sentiment data with traditional technical indicators like Moving Averages, RSI, and MACD, traders can form a hybrid model. For example, if the technical indicators suggest an uptrend and the sentiment analysis concurrently registers positive market sentiment, the confluence of these signals might result in a high-confidence "BUY" recommendation. This dual-layered approach minimizes false signals and improves overall strategy robustness.

Integration with Crypto Trading Systems

The integration of AI-driven sentiment analysis with existing trading systems can be achieved through APIs and modular code design. Several GitHub repositories provide a blueprint for this integration:

- Vanclief/twitter-sentiment-analysis: A project that demonstrates the use of Twitter sentiment to influence crypto trading decisions.

- phillipiv/cryptocurrency-trading-with-sentiment-analysis: A simple trading algorithm that uses Twitter sentiment analysis, which can be adapted for real-time decision-making.

- cryptocontrol/sentiment-trading-bot: A Java-based bot that uses sentiment from crypto news articles to automate trading, illustrating cross-language implementation.

At aidea solutions, we leverage these open-source projects and build upon them to create proprietary tools that integrate seamlessly with our trading platforms. This allows us to deliver real-time, actionable insights to our clients, optimizing trading strategies based on both quantitative technical indicators and qualitative sentiment data.

Challenges and Considerations

While AI-driven sentiment analysis holds immense promise, several challenges must be addressed:

- Data Quality and Noise: Social media and news sources are filled with noise, spam, and sometimes contradictory information. Filtering out irrelevant data is crucial.

- Real-Time Processing: The volume of data in the crypto market is enormous. Ensuring that your system can process and analyze this data in real time requires robust architecture and efficient code.

- False Signals: AI models can sometimes misinterpret sarcasm, irony, or context-dependent language. Continuous model training and fine-tuning on domain-specific datasets are necessary.

- Market Manipulation: Coordinated pump-and-dump schemes and bot activity can skew sentiment analysis. Incorporating additional filters and cross-validating with on-chain metrics can help mitigate this risk.

- Integration Complexity: Merging sentiment analysis with technical analysis and trading execution systems demands careful planning, testing, and monitoring to ensure that the overall strategy remains sound.

Conclusion

AI-driven sentiment analysis is revolutionizing the way traders navigate the volatile world of cryptocurrencies. By transforming qualitative data from social media, news, and forums into quantitative signals, sentiment analysis adds a crucial layer of insight that complements traditional technical analysis. While challenges such as data noise and false signals exist, continuous improvement through model fine-tuning and hybrid strategies can significantly enhance trading outcomes.

At Aidea Solutions, our commitment is to push the boundaries of what’s possible in crypto trading by integrating advanced AI technologies with real-time market data. Whether you’re looking to detect pump-and-dump schemes, gauge market reactions to regulatory news, or combine sentiment with technical indicators, the future of crypto trading lies in harnessing the power of AI.

For a deeper technical dive or to explore our sentiment analysis solutions, feel free to reach out to us at info@aideasolutions.net.

Harnessing AI-Driven Sentiment Analysis for Crypto Trading: A Deep Dive